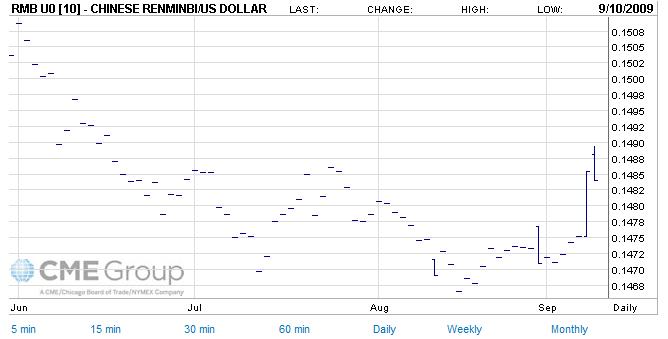

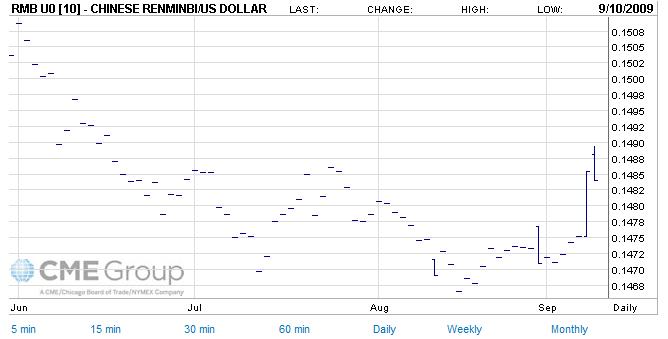

In the same month, China’s foreign exchange reserves fell by the most since late 2016. In April alone, it posted its biggest monthly drop on record. In the past three months, the yuan has lost about 7% of its value against the greenback. The currency recovered later in the day to stand around 6.78 per US dollar. The yuan - also known as the renminbi - hit its lowest levels since September 2020 early on Friday in the onshore market that Beijing controls as well as offshore, where it can trade more freely. The links have raised fears that China could be targeted by Western sanctions if it helps Moscow. Since the start of the year, investors have been moving money out of China, driven by concerns about rising lockdowns in major cities, and Beijing’s close ties with Moscow in the wake of Russia’s invasion of Ukraine. You are welcome to present the relevant documents and conduct foreign exchange settlement at HSBC local branches.The Chinese currency is declining rapidly as the world’s second largest economy falters under the weight of Covid restrictions.

When converting RMB proceeds from the sale of a property, you can refer to Detailed Rules for Implementing the Measures for the Administration on Individual Foreign Exchange ] and Operating Guidelines for Foreign Exchange Transactions for Direct Investment within Circular on Further Simplifying and Improving Policies for Foreign Exchange Administration for Direct Investment ] for further information. If the total amount converted in the same day is not more than USD500 equivalent (including USD500), or the total amount converted in the same day at premises within mainland China's borders, but outside of China's Customs before your departure is not more than USD1,000 equivalent (including USD1,000), you need only present your valid identity certificate in order to reconvert the unused portion of RMB to the original foreign currency. The validity term of the original exchange voucher is 24 months from the exchange date. In order to reconvert an unused portion of RMB previously converted from a foreign currency back into the original foreign currency you must present your valid identity certificate and the original exchange voucher. When the legal income of RMB comes from salary or other types of income issued from a foreign-investment enterprise to non-China nationals/Hong Kong, Macau, Taiwan residents/overseas Chinese, you should purchase foreign exchange by presenting your relevant certificate and documents subject to your after-tax income. With regard to the legal income in RMB under the Current Account FCY Funds held within Mainland China's borders, you should purchase foreign exchange by presenting your valid identity certificate and the related evidential materials (inclusive of tax voucher). Valid identity certificate and the related evidential materials should be presented at HSBC local branches for application: There is no quota for overseas customers wishing to purchase FCY. Please arrange your transaction time properly. By that time, customers can’t do Foreign Exchange related services via Online Banking, Mobile Banking, and WeChat banking. *Our bank will end the Foreign Exchange settlement and purchase services on the digital channel at 16:30 before the holiday. (excluding public holidays in mainland China*)Branches: 9:00 - 17:00, Monday to Friday (excluding public holidays in mainland China) Visit our branches with your valid identity certificate and other documents (if applicable)įor branch transactions, settlement and purchase transactions are available to both domestic and non-domestic customers with valid ID and related supporting documents, if necessary.įor e-banking, settlement transactions are available to both domestic and non-domestic customers purchase transactions are available to domestic customers only. Digital Channel Service Hours: USD/CNY conversion:9:30 to 22:00 Monday - Friday, other currency/CNY conversion: 9:30 - 18:00, Monday – Friday. To conduct foreign exchange settlement/purchases, you can either:

For foreign individuals, the annual quota of settlement is USD 50,000 equivalent.

Individual Foreign Exchange Purchase Business allows customers to purchase foreign currencies from HSBC.Īccording to the regulation set out for individual foreign currency conversion by the State Administration of Foreign Exchange, for domestic individuals the annual quota of settlement and purchase is USD50,000 equivalent. Individual Foreign Exchange Settlement Business allows customers to sell their foreign currencies to HSBC at our foreign exchange rates in return for the equivalent amount in RMB.

0 kommentar(er)

0 kommentar(er)